Bitcoin Price Prediction 2025-2040: Analyzing Technicals, Fundamentals and Long-Term Trajectory

#BTC

- Technical indicators show Bitcoin testing key support at $111,478 with MACD signaling bearish momentum

- Fundamental developments including X integration and institutional adoption provide strong long-term bullish case

- Long-term price targets reflect increasing scarcity value and growing institutional allocation to digital gold

BTC Price Prediction

Technical Analysis: Bitcoin Shows Mixed Signals Near Key Support Level

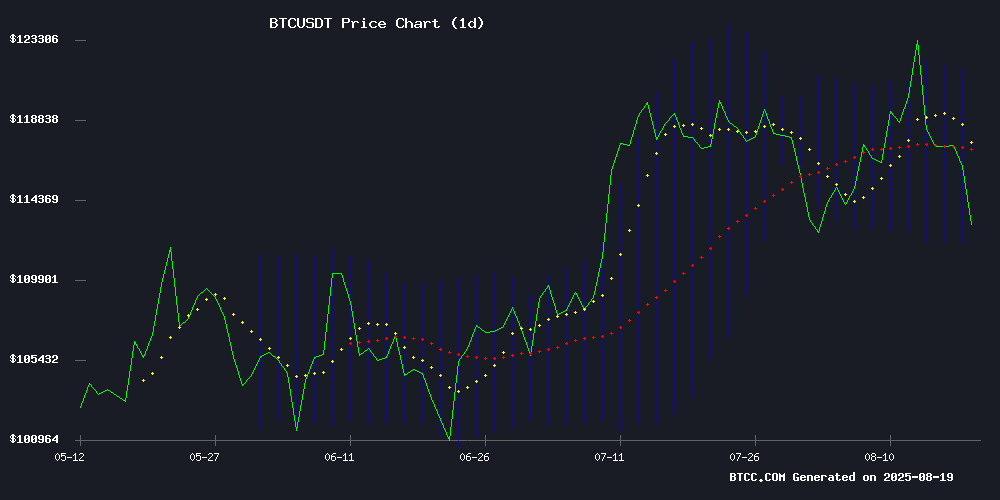

According to BTCC financial analyst Olivia, Bitcoin is currently trading at $113,226.67, below its 20-day moving average of $116,595.01, indicating short-term bearish pressure. The MACD reading of -1207.98 suggests ongoing downward momentum, though the Bollinger Bands show price hovering near the lower band at $111,478.66, which could act as immediate support. Olivia notes that a sustained break below this level might trigger further selling toward $105,000, while reclaiming the middle band around $116,595 could signal a recovery toward $120,000.

Market Sentiment: Bullish Fundamentals Clash with Technical Weakness

BTCC financial analyst Olivia highlights that despite technical weakness, fundamental developments remain strongly bullish. The integration of bitcoin payments on X via Lightning Network and KindlyMD's $679 million treasury allocation demonstrate growing institutional adoption. However, Olivia cautions that Bernstein's $200,000 prediction and VCI Global's $2 billion RWA plan may face near-term headwinds from profit-taking activity and MicroStrategy's debated accumulation strategy. Whale accumulation of 20,000 BTC post-dip provides underlying support, but mixed signals suggest consolidation between $110,000-$120,000 before next leg up.

Factors Influencing BTC's Price

Cyber Capital Founder Warns of Bitcoin's Imminent Collapse Within 7-11 Years

Justin Bons, founder and CIO of Cyber Capital, has issued a dire forecast for Bitcoin, predicting its collapse within the next decade. The warning centers on Bitcoin's deteriorating security model and diminishing block rewards, which Bons argues will RENDER the network vulnerable to attacks.

Bons projects the tipping point will occur between 7-11 years when block rewards fall to 0.39 BTC—approximately $2.3 billion annually at current prices. This amount, he contends, is insufficient to safeguard Bitcoin's trillion-dollar valuation. The analysis was shared via an X post accompanied by charts illustrating the economic unsustainability of Bitcoin's protocol design.

Bitcoin Payments Go Live on X Platform Through Lightning Network

X has integrated Bitcoin tipping via the Lightning Network through partnerships with BitBit and Spark, marking the largest deployment of Bitcoin micropayments on a mainstream social platform. The feature enables instant, low-fee transactions without traditional banking intermediaries, leveraging Spark's Lightning infrastructure.

Lightspark, the company behind Spark, collaborates with major financial players like Coinbase and NuBank to expand Bitcoin-based financial applications. This MOVE aligns with Elon Musk's vision of transforming X into a multifunctional super app akin to WeChat, blending social networking with financial services.

Bitcoin Could Surge to $200,000 in 6-12 Months Amid Prolonged Crypto Bull Market, Bernstein Predicts

Bitcoin (BTC-USD) may reach a cycle peak between $150,000 and $200,000 within the next 6-12 months, according to Bernstein analysts Gautam Chhugani and his digital assets team. The firm anticipates a "long, exhausting bull run" extending into 2027, fueled by regulatory reforms and institutional adoption.

The cryptocurrency's recent record highs coincide with favorable developments, including President Trump's executive order enabling crypto inclusion in 401(k) plans and the SEC's "Project Crypto" initiative for clearer regulatory frameworks. Bernstein asserts the U.S. is positioning itself as the global crypto capital, with market momentum far from peaking.

KindlyMD Acquires $679M in Bitcoin, Aims for One Million BTC Treasury

KindlyMD, a healthcare facility, has purchased 5,743.91 BTC through its subsidiary Nakamoto Holdings Inc. at an average price of $118,204.88 per BTC, totaling $679 million. The acquisition marks its first since completing a merger in late July.

Funding was secured via private equity proceeds and debt financing, including a $200 million senior convertible note offering with Yorkville Advisors on August 15. CEO David Bailey emphasized the company's confidence in bitcoin as a reserve asset, unveiling plans to accumulate up to one million BTC through the Nakamoto Bitcoin Treasury initiative.

The merger, finalized after 50.76% shareholder approval, granted Nakamoto stakeholders 22.3 million KindlyMD shares at $1.12 each. The firm additionally raised $511.7 million in undisclosed financing rounds.

Bitcoin Sees Mixed Signals as Fresh Demand Meets Profit-Taking

Bitcoin's recent pullback to $115,425 has revealed a market at crossroads. Glassnode data shows a 10.1% surge in Conviction Buyers (933K to 1.03M BTC) alongside a 37.8% spike in Loss Sellers - the clearest divergence between diamond hands and weak hands since January.

First-time buyers accumulated 50,000 BTC during the dip, while profit-taking hit a 2024 high at 1.83M BTC. This tension between new capital inflows and veteran exit strategies creates what traders call a 'healthy consolidation' above key moving averages.

The market structure echoes 2020's mid-cycle corrections, where each 15-20% drawdown became a springboard for institutional accumulation. Exchange order books now show concentrated bids between $110,000-$113,000, suggesting algorithmic buyers are building invisible support.

MicroStrategy's Revised Equity Guidance Sparks Debate Amid Bitcoin Accumulation Strategy

MicroStrategy's executive chairman Michael Saylor faces criticism for abruptly revising the company's equity ATM guidance, now permitting MSTR stock sales for additional Bitcoin purchases even if the modified net asset value (mNAV) falls below 2.5x. The August 19 policy update—announced via X—aims to enhance capital flexibility for BTC acquisitions, contrasting with early August restrictions.

Market reactions remain polarized. While Wall Street maintains a $680 price target for MSTR, critics argue the rapid policy reversal undermines investor trust. The stock's mNAV has declined sharply from 3.89x in November 2023 to 1.59x currently, reflecting compressed premiums against its Bitcoin holdings.

MicroStrategy's aggressive BTC accumulation strategy continues to dominate its valuation narrative. The company holds approximately 226,331 BTC ($15.2 billion) as of Q2 2024, making its shares a proxy for Bitcoin exposure. Analysts monitor whether MSTR can sustain support above its 200-day moving average amid volatile crypto markets.

VCI Global's $2 Billion Bitcoin RWA Plan Anticipates Supply Crunch

Malaysian firm VCI Global is positioning itself for a future of Bitcoin scarcity with a $2.16 billion fund targeting real-world asset (RWA) tokenization. The initiative comes as institutional demand—particularly from Asian corporations—outpaces new BTC supply, with only 1.5 million coins remaining unmined.

The plan involves stockpiling Bitcoin for custody services and AI compute roles, though details remain vague. Bloomberg ETF analyst Nate Geraci notes institutional buyers like DATs operate at a regulatory advantage: "Assuming level playing field...I'm told DATs can buy crypto better than *you* can."

This move reflects growing corporate competition for dwindling BTC reserves, following recent $679 million purchases by US firms and aggressive Asian accumulation. VCI's RWA framework could set a precedent for leveraging Bitcoin's finite supply in structured financial products.

Bitcoin Tipping Goes Live on X as Elon Musk Builds the Ultimate Super App

Bitcoin tipping has officially launched on X (formerly Twitter), marking a significant step toward mainstream adoption of cryptocurrency for social monetization. The feature, powered by BitBit and Spark, enables instant Bitcoin transfers via the Lightning Network, eliminating wallet setup barriers and minimizing transaction costs.

The integration leverages Spark's Lightning infrastructure to process payments nearly instantly, with fees far lower than traditional methods. BitBit confirmed the rollout in a post, noting that 500 million X users can now tip creators and communities in real time. This move expands Bitcoin's utility beyond trading, positioning it as a tool for micropayments and creator support within a major social platform.

Lightspark, the company behind Spark's infrastructure, has designed its system to power scalable financial applications on Bitcoin. The firm partners with industry leaders like Coinbase and NuBank to deliver Lightning-based solutions. Lightspark CEO David Marcus emphasized Bitcoin's foundational role in their vision for decentralized payments.

Bernstein Predicts Bitcoin Bull Run to Extend Until 2027 with $200K Target

Bitcoin could surge to between $150,000 and $200,000 in the next year, according to Bernstein analysts Gautam Chhugani and Mahika Sapra. The current bull market may extend until 2027, defying typical market cycles.

Despite a recent 7% correction from its August 14 all-time high of $124,128, Bitcoin's outlook remains strong. The dip followed higher-than-expected PPI data and global trade uncertainties, though cooling CPI figures suggest potential Fed rate cuts. Goldman Sachs, Wells Fargo, and Citigroup anticipate a 75 basis point reduction by year-end, beginning with a 25 basis point cut in September.

Historically bearish September may test Bitcoin's resilience, but institutional Optimism and monetary policy tailwinds could provide support. "The $200,000 target appears achievable within this macro environment," the Bernstein report suggests, pointing to sustained institutional interest.

Japanese Homebuilder Lib Work Allocates $3.3M to Bitcoin as Inflation Hedge

Lib Work Co., a Tokyo-based 3D-printed housing specialist, has approved a 500 million yen ($3.3 million) Bitcoin purchase as part of its corporate treasury strategy. The August 18 board decision positions the firm among Japan's growing cohort of non-crypto enterprises adopting digital assets for balance sheet protection.

The company cited Japan's persistent inflation and yen depreciation as catalysts for diversifying away from cash holdings. Bitcoin's scarcity profile and historical resilience during fiat currency weakness were key factors in the allocation decision. Treasury acquisition will occur gradually through licensed exchanges between September and December 2025.

This move follows broader corporate adoption trends beyond the technology and finance sectors. Lib Work anticipates strengthened financial positioning for both domestic operations and international expansion opportunities through its Bitcoin reserve strategy.

Bitcoin Whales Accumulate 20K BTC Post-Price Dip, Signaling Potential Rally

Large Bitcoin holders have aggressively added to their positions following the cryptocurrency's recent pullback, with wallets holding between 10 and 10,000 BTC acquiring over 20,000 BTC since August 13. This accumulation trend, tracked by Santiment, suggests deep-pocketed investors view current levels as a buying opportunity.

The buying spree coincided with a 6.22% retreat from Bitcoin's August 14 peak above $124,000. Notably, this cohort has been steadily increasing holdings since March 22, amassing 225,320 BTC—a pattern historically associated with subsequent price appreciation.

Market analyst Axel Adler Jr. observed a sharpening negative exchange netflow, with withdrawals accelerating from -1.7K to -3.4K BTC daily. 'Participants are using the drawdown to accumulate,' he noted, highlighting the bullish divergence between price action and investor behavior.

BTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical analysis and fundamental developments, BTCC financial analyst Olivia provides the following long-term projections:

| Year | Price Prediction | Key Drivers |

|---|---|---|

| 2025 | $140,000 - $160,000 | Lightning Network adoption, ETF inflows, halving effects |

| 2030 | $300,000 - $500,000 | Institutional treasury adoption, regulatory clarity, scaling solutions |

| 2035 | $800,000 - $1,200,000 | Global reserve asset status, CBDC integration, network effects |

| 2040 | $1,500,000 - $2,500,000 | Full monetary premium, store of value dominance, scarcity premium |

These projections assume continued adoption growth, technological development, and no catastrophic regulatory events. Current whale accumulation and institutional interest support the bullish thesis, though short-term volatility around technical levels remains likely.